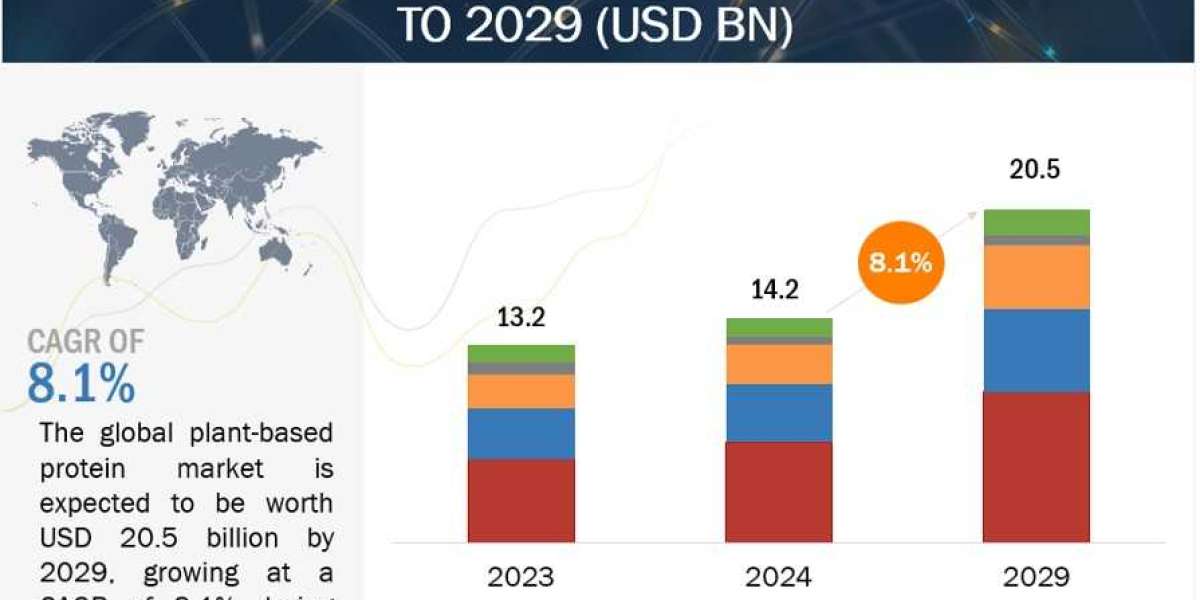

The "https://www.marketsandmarkets.com/Market-Reports/plant-based-protein-market-14715651.html">plant-based protein market is estimated at USD 14.2 billion in 2024 and is projected to reach USD 20.5 billion by 2029, at a CAGR of 8.1% from 2024 to 2029. The plant-based protein market has seen exponential growth in recent years, fueled by increasing consumer awareness of health, environmental sustainability, and ethical concerns regarding animal agriculture. This market encompasses a wide range of products derived from sources like soy, pea, wheat, rice, and other plant-based sources, providing alternatives to traditional animal-derived proteins. With the rise of flexitarian, vegetarian, and vegan diets, there has been a surge in demand for plant-based protein products across various categories, including meat substitutes, dairy alternatives, snacks, and beverages.

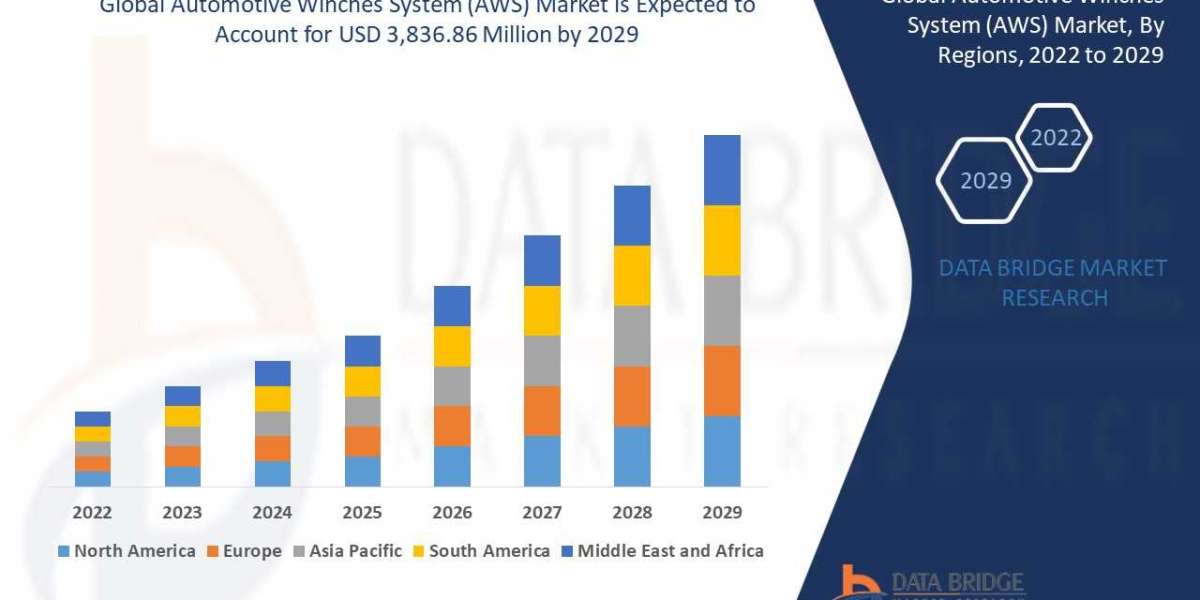

The North American region is estimated to dominate the plant-based protein market

The increasing desire for plant-based proteins in North America stems from various factors reflecting changing consumer tastes, heightened environmental awareness, increased health consciousness, and recognition of the benefits of plant-focused diets. Particularly, health-conscious individuals in the region are favoring plant-based proteins over animal products due to their reduced saturated fat and cholesterol levels. Additionally, rising concerns regarding the environmental repercussions of animal farming, including deforestation, greenhouse gas emissions, and water usage, have prompted consumers to see plant-based proteins as a more sustainable and environmentally friendly option.

Speak to Analyst: "https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=14715651">https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=14715651

Key Players in the Market

Key Market Players in this include Tate Lyle PLC (London), Kerry Group PLC (Ireland), DSM Firmenich (Switzerland, ADM (US), Cargill Incorporated (US), International Flavors Fragrances Inc. (US), Ingredion (US), Roquette Frères (France), Wilmar International Ltd. (Singapore), Glanbia plc (Ireland), Kerry Group PLC (Ireland), DSM-Firmenich (Switzerland), AGT Food and Ingredients (Canada), Burcon NutraScience Corporation (Canada), Emsland Group (Germany), PURIS (US), COSUCRA (Belgium), Tate Lyle (UK).

Pea sub-source is estimated to be the fastest source segment in the plant-based protein market during the forecasted period 2024-2029

In recent years, there has been a significant uptick in the popularity of pea protein within the plant-based protein sector, attributed to changing consumer preferences away from conventional sources like soy. Derived from yellow split peas, pea protein is available in three primary forms: pea protein isolate, pea protein concentrate, and textured pea protein. Pea protein isolate, boasting a high protein concentration, is obtained through wet fractionation, while pea protein concentrates, featuring a lower protein content, are acquired through dry fractionation. Textured pea protein finds extensive application in various food items, particularly in plant-based meat substitutes. Key industry players such as Roquette Frères and Ingredion have been expanding their production capacities and introducing novel pea protein products to cater to the escalating demand. For instance, in February 2023, Roquette Frères augmented its Nutrahs plant protein portfolio by launching four new pea protein ingredients, encompassing isolates, hydrolysates, and textured variants. These versatile pea proteins are engineered to tackle formulation hurdles in plant-based foods and high-protein nutritional items, opening avenues for innovation across segments like nutritional bars, protein beverages, and plant-based alternatives to meat and dairy products.