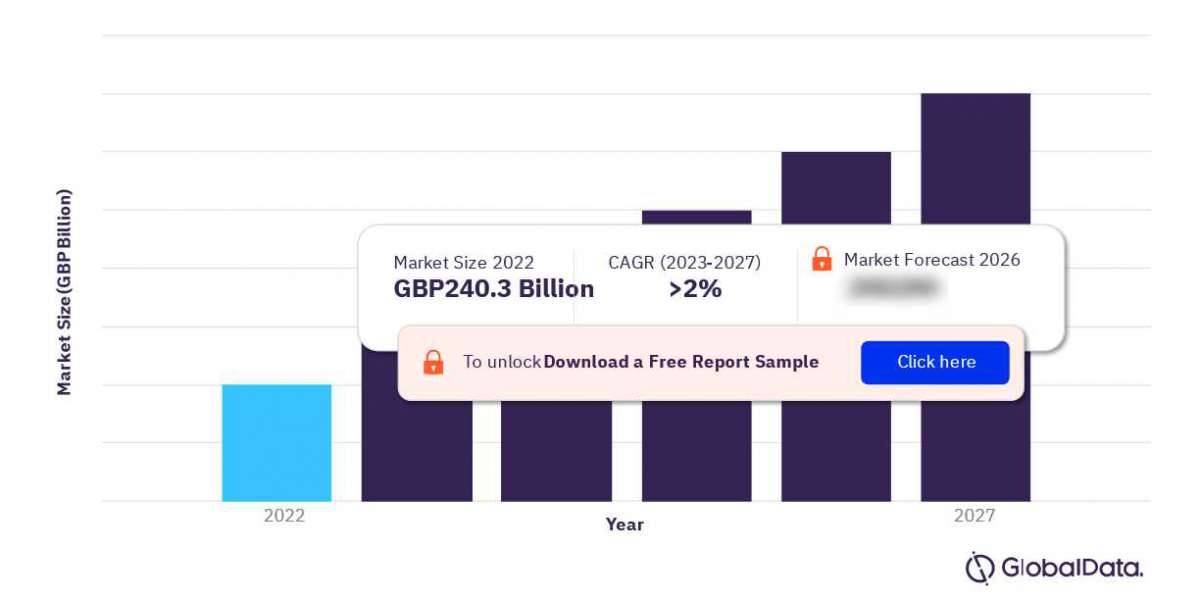

Market Size and Importance: The UK life insurance market is one of the largest in Europe and globally. It comprises a wide range of insurance products, including term life insurance, whole life insurance, critical illness insurance, and more. These products are designed to help individuals and families mitigate financial risks associated with illness, death, and other life events.

Regulation: The industry is regulated by the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA). These regulatory bodies ensure that insurance providers operate within the framework of consumer protection and financial stability.

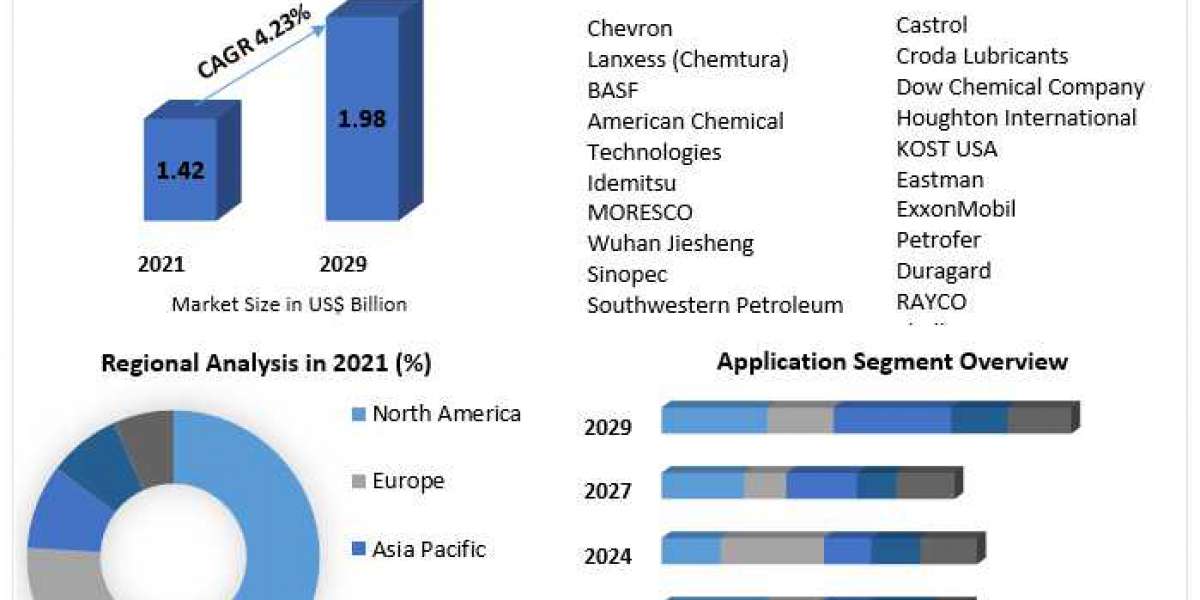

Competitive Landscape: The UK life insurance market is highly competitive, with numerous insurance companies, both domestic and international, offering a variety of products and services. This competition often leads to innovation and better pricing for consumers.

Consumer Demand: Life insurance products are in demand among UK consumers who seek financial security for their loved ones. Factors such as an aging population, increased awareness of the need for protection, and favorable tax treatment for life insurance products contribute to this demand.

Types of Life Insurance: There are different types of life insurance available in the UK, catering to various needs. Term life insurance provides coverage for a specified period, while whole life insurance covers the policyholder's entire life. Critical illness insurance pays out upon diagnosis of a specified illness, and income protection insurance provides income replacement in case of disability.

Distribution Channels: Life insurance products are typically distributed through various channels, including insurance brokers, financial advisors, and online platforms. Many consumers prefer to purchase policies through intermediaries who can provide personalized advice.

Challenges: The industry faces challenges such as increasing regulatory scrutiny, changing customer preferences, and the need to adapt to emerging technologies. Insurers must also manage risk effectively to ensure they can meet their long-term financial obligations to policyholders.

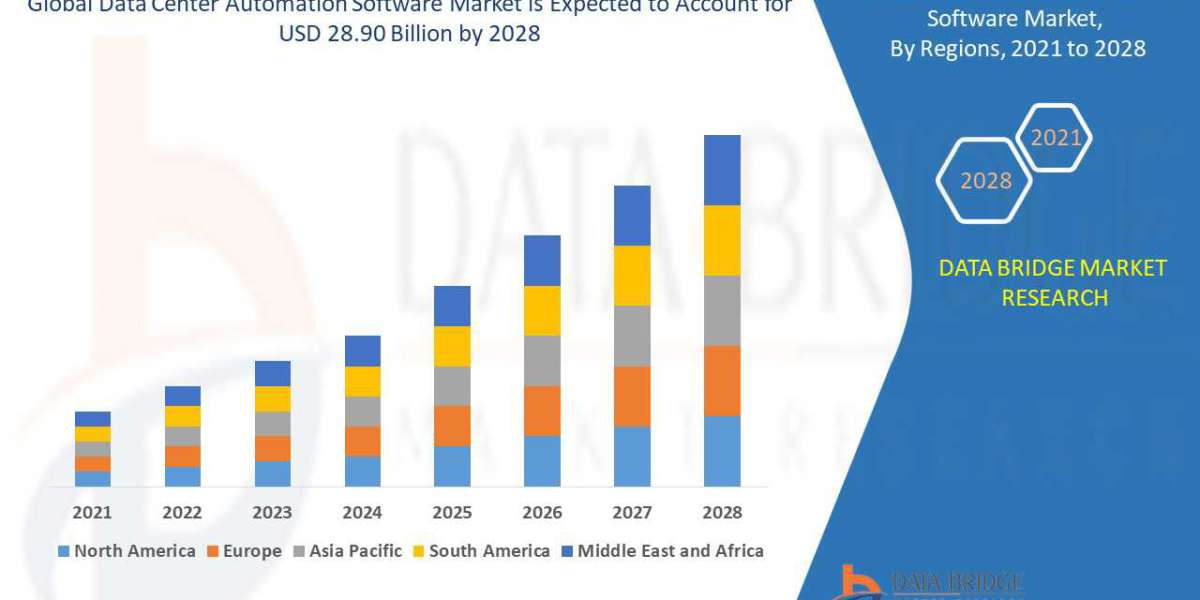

Innovation: Insurers are embracing digital technologies and data analytics to streamline processes, offer more tailored products, and enhance customer experiences. Additionally, there's a growing emphasis on sustainable and socially responsible investment options within life insurance products.

Tax Benefits: In the UK, life insurance policies often come with tax benefits. For instance, the payout from a life insurance policy is typically exempt from income tax and inheritance tax.

Public Awareness and Education: Public awareness and education about the importance of life insurance continue to be a focus for the industry and regulatory authorities. This includes initiatives to improve financial literacy and encourage more people to secure their financial future through life insurance.

In summary, the UK life insurance market is a dynamic and vital part of the financial services sector. It offers a wide range of products to meet the diverse needs of individuals and families, and it plays a critical role in providing financial security and peace of mind in an uncertain world.

To gain more information about the UK life insurance market forecast, download a free report sample