In this article, we will delve into the intricacies of the "https://www.globaldata.com/store/report/mobile-wallet-market-analysis/?utm_source=off-pageutm_medium=web2.0utm_campaign=off-page">mobile wallet market, exploring its features, market dynamics, and the transformative impact it has on the financial landscape.

Introduction to Mobile Wallets

Mobile wallets, often referred to as digital wallets or e-wallets, are digital versions of your physical wallet. They store payment information securely, allowing users to make transactions with a simple tap on their smartphones. The evolution of mobile wallets has been remarkable, starting from basic payment functionalities to becoming comprehensive financial management tools.

Key Features of Mobile Wallets

Security Measures

One of the primary concerns users have is the security of their financial information. Mobile wallets address this with robust security measures, including encryption, tokenization, and biometric authentication, ensuring that your data remains confidential.

Convenience and Accessibility

The hallmark of mobile wallets lies in their convenience. Users can store multiple cards, link bank accounts, and access a myriad of financial services, all within a single app. The accessibility offered by mobile wallets has made them indispensable for users on the go.

Integration with Various Payment Methods

Mobile wallets seamlessly integrate with different payment methods, from credit and debit cards to digital currencies. This flexibility makes them versatile, catering to a diverse user base with varying preferences.

Popular Mobile Wallets in the Market

The mobile wallet market is teeming with competition, with several players vying for dominance. Notable names include Apple Pay, Google Pay, Samsung Pay, and various region-specific wallets. Each of these wallets brings unique features to the table, contributing to the vibrant ecosystem.

Overview of Leading Players

Apple Pay stands out for its seamless integration with Apple devices, while Google Pay leverages the expansive Android user base. Samsung Pay, with its MST technology, offers compatibility with traditional magnetic stripe terminals, providing an edge in terms of merchant acceptance.

Unique Features of Each Wallet

Distinguishing factors among wallets include loyalty programs, in-app payment options, and partnerships with businesses. Understanding these nuances helps users choose the wallet that aligns with their preferences and lifestyle.

Market Growth and Trends

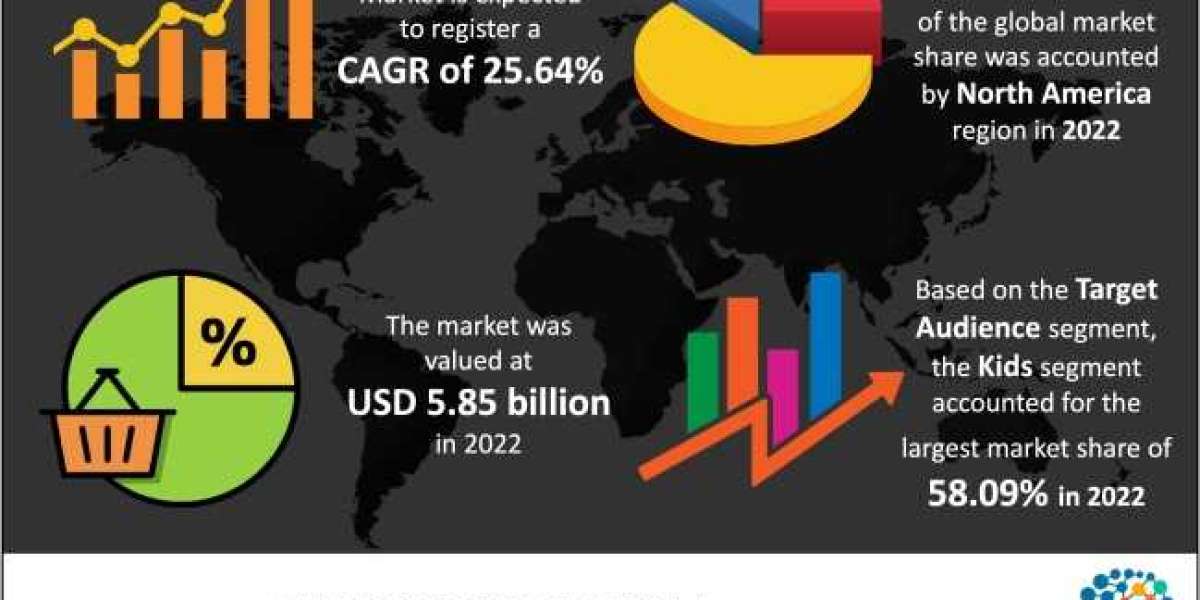

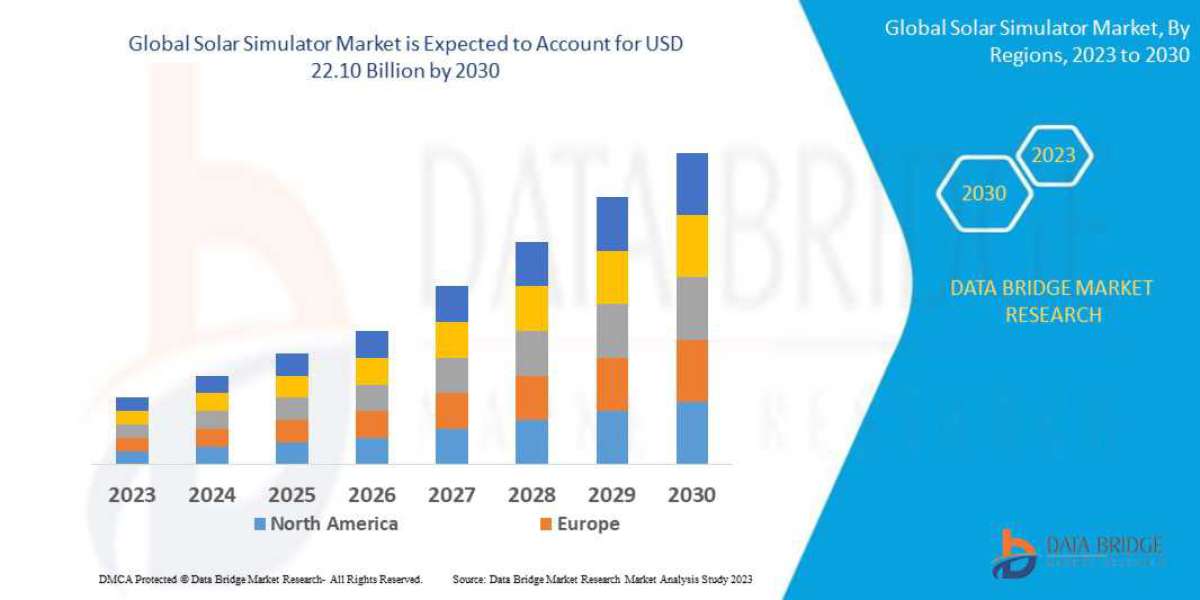

The mobile wallet market has witnessed exponential growth in recent years, driven by factors such as increasing smartphone penetration, rising preference for cashless transactions, and advancements in technology.

Statistics and Figures

As of [latest data], the global mobile wallet market is valued at [amount], with projections indicating a [percentage] CAGR over the next [number] years. These figures underscore the industry's robust growth trajectory.

Emerging Trends Shaping the Market

The market is dynamic, with trends like contactless payments, QR code integration, and the rise of peer-to-peer (P2P) transactions gaining prominence. These trends not only reflect user preferences but also push the boundaries of what mobile wallets can offer.

Benefits for Users

Users flock to mobile wallets not only for the sheer convenience but also for the array of benefits they provide.

Streamlined Transactions

Mobile wallets streamline transactions, reducing the time and effort required for payments. Whether it's splitting a bill with friends or making quick online purchases, the process becomes frictionless.

Rewards and Loyalty Programs

Many mobile wallets entice users with rewards and loyalty programs. From cashback on purchases to exclusive discounts, these incentives add an extra layer of value for users.

Budgeting and Financial Management

Some mobile wallets go beyond transactions, offering tools for budgeting and financial management. Users can track expenses, set savings goals, and gain insights into their spending habits.

Challenges and Concerns

While the advantages are evident, the mobile wallet landscape is not without its challenges.

Security Issues

Despite advancements in security measures, concerns about data breaches and unauthorized access persist. Addressing these concerns is crucial to maintaining user trust.

Limited Merchant Acceptance

In certain regions, mobile wallet acceptance among merchants is not universal. This limitation can be a hurdle for users who rely heavily on digital payments.

User Resistance and Awareness

Some users remain resistant to adopting mobile wallets due to a lack of awareness or a preference for traditional payment methods. Overcoming this resistance requires targeted education and awareness campaigns.

Mobile Wallets and the Future of Finance

The impact of mobile wallets extends beyond individual transactions; it has the potential to reshape the entire financial landscape.

Impact on Traditional Banking

Mobile wallets challenge traditional banking models by offering users a more agile and personalized financial experience. This shift prompts traditional banks to adapt and innovate to stay relevant.

Innovations on the Horizon

The future promises exciting innovations, including enhanced security features, integration with emerging technologies like blockchain, and the evolution of user interfaces. These innovations will further propel the mobile wallet market forward.

Global Adoption of Mobile Wallets

The adoption of mobile wallets varies across regions, influenced by factors such as technological infrastructure, regulatory environment, and cultural norms.

Regional Variations in Usage

In some regions, mobile wallets are deeply ingrained in daily life, with a majority of transactions conducted digitally. In contrast, other areas may still be in the early stages of adoption.

View Sample Report for Additional Insights on Mobile Wallet Market Forecast, "https://www.globaldata.com/store/talk-to-us/?report=3698384">Download a Free Report Sample